How Insurance Plans Use Generic Drugs to Lower Prescription Costs

When you pick up a prescription at the pharmacy, you might not realize that the price you pay has less to do with the medicine itself and more to do with how your insurance plan is built. Health insurers and pharmacy benefit managers (PBMs) don’t just cover drugs-they actively shape which drugs you get, and how much you pay for them. The main tool they use? Generic drugs.

Generics aren’t cheap knockoffs. They’re FDA-approved copies of brand-name drugs that work the same way, with the same active ingredients, dosage, and safety profile. But they cost 80% to 85% less. That’s why insurance plans push them hard. In 2022, 91.5% of all prescriptions filled in the U.S. were for generics, yet they made up only 22% of total drug spending. That’s a $370 billion annual savings for the system-and it’s all built into the design of your coverage.

How Insurance Plans Push Generics

It’s not enough to just offer generics. Insurance plans need to make them the easiest, cheapest, and most logical choice. They do this through a set of structured rules called benefit design. The most common method is the tiered formulary.

Think of it like a pricing ladder. Tier 1 is for generics-often $0 to $10 for a 30-day supply. Tier 2 is for preferred brand-name drugs, usually $25 to $50. Tier 3 is for non-preferred brands, which can cost $60 or more. Some plans even have a Tier 4 for specialty drugs that cost hundreds. The system is designed so that switching to a generic saves you money immediately. In 2024, Kaiser Family Foundation data showed that over half of commercial plans had $0 copays for generics, while brand-name drugs still carried $30+ copays.

But it doesn’t stop there. Most plans use mandatory generic substitution. If a generic exists, your pharmacist can swap it in without asking your doctor-unless your doctor specifically writes "dispense as written" on the prescription. All 50 states allow this, and 49 of them let pharmacists make the switch automatically. It’s not a suggestion. It’s policy.

Another layer is step therapy. This means you have to try the generic first before your plan will pay for the brand-name version. In 2023, 92% of Medicare Part D plans required this. If you need a brand-name drug for a condition like high blood pressure or depression, your insurer will ask: "Did you try the generic?" If you didn’t, they won’t cover the more expensive option.

Who Wins? Who Loses?

On paper, this system looks like a win-win. Insurers save money. Employers save money. Patients pay less. The numbers back it up: generics saved the U.S. healthcare system $3.7 trillion between 2013 and 2022. For seniors on Medicare Part D, 68% reported being satisfied with their generic coverage in a 2024 Kaiser survey.

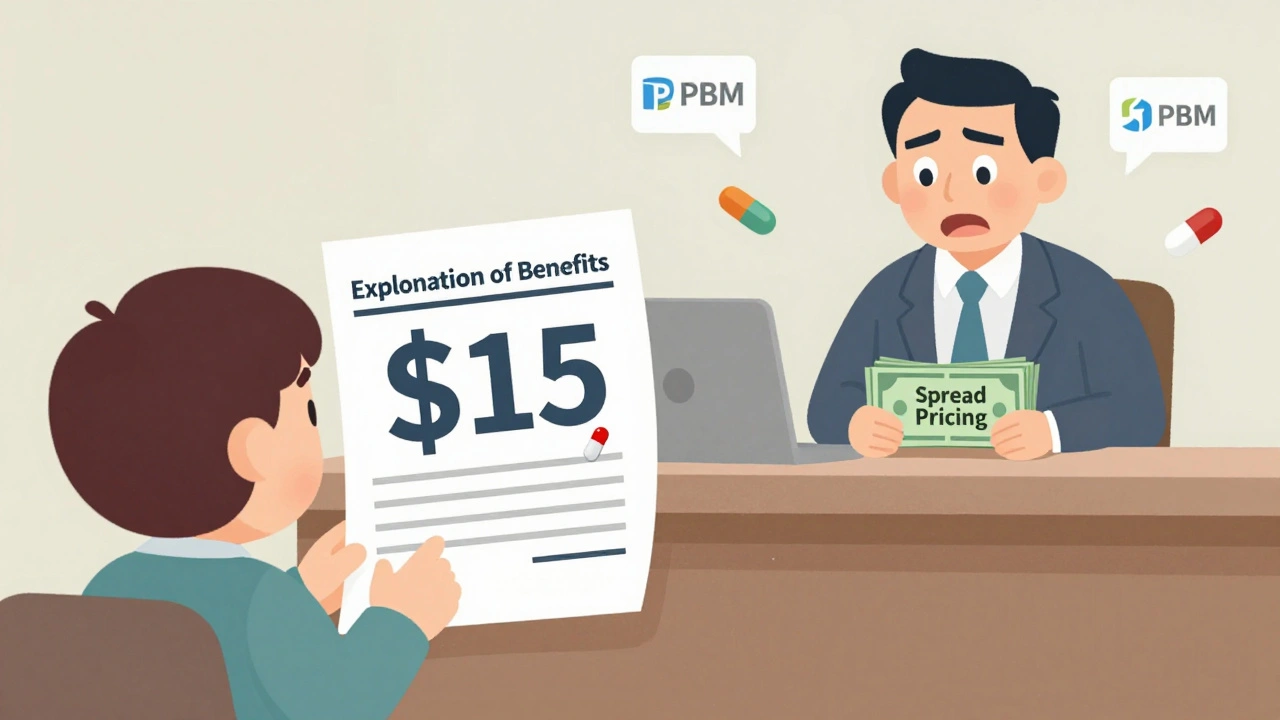

But the reality is messier. Many patients don’t realize they’re paying more than they should. The problem? Spread pricing and copay clawbacks.

Here’s how it works: Your insurance plan tells the pharmacy it will pay $15 for a generic drug. But the pharmacy only paid $5 to buy it. The $10 difference? That’s the spread. The PBM keeps it. Meanwhile, your copay is based on the $15 price-not the $5 cost. So even though the drug is cheap, you’re charged as if it’s expensive. In some cases, patients pay $10-$15 more per prescription than they should. The USC Schaeffer Center found this practice is widespread, especially in commercial plans.

Another issue is therapeutic substitution. Sometimes, a generic isn’t just a copy-it’s a different chemical version of the same drug. For some patients, that small difference causes side effects. A 2023 Medscape poll found that 31% of doctors reported patients having problems after being switched to a generic by their insurance. These aren’t rare cases. They’re built into the system.

How Different Plans Handle Generics

Not all insurance plans are the same. Medicare Part D, Medicaid, and employer plans all use generics-but in different ways.

Medicare Part D has standardized tiers, but copays vary widely. In 2024, some plans charged $0 for generics. Others charged up to $15. The out-of-pocket cap of $2,000, which started in 2025, changed the game. Seniors now have more incentive to stick with generics because every dollar counts toward that cap.

Medicaid uses federal price caps. States can’t pay more than 250% of the average manufacturer price for generics. In 2022, Medicaid had a higher generic dispensing rate (89.3%) than commercial plans (87.1%). That’s partly because Medicaid patients often have no other choice-many can’t afford brand-name drugs even with insurance.

Commercial plans are where the most innovation-and controversy-happens. Many employers now offer high-deductible health plans (HDHPs) with Health Savings Accounts (HSAs). These plans often have lower generic copays even before you meet your deductible. Some self-insured employers have cut drug costs by 9% to 15% just by switching patients to generics, without any drop in health outcomes, according to a Johns Hopkins study.

Then there’s the new kid on the block: direct-to-consumer pharmacies like Mark Cuban Cost Plus Drug Company. They sell generics at cost plus a flat 15% fee. In 2023, patients saved a median of $4.96 per prescription compared to insurance-based pricing. But this only helps the uninsured or those whose insurance doesn’t cover the drug. Medicaid and Medicare beneficiaries usually can’t use these services.

The Hidden Costs of Generic-First Policies

It’s easy to think that pushing generics is always good. But the system has blind spots.

First, there’s the transparency gap. Most patients don’t understand how their copay is calculated. A Commonwealth Fund study in 2023 found only 38% of Medicare beneficiaries could explain how their generic coverage worked. When your Explanation of Benefits (EOB) says "You paid $15 for a generic," you assume that’s the price. But it’s not. It’s a number pulled out of thin air by the PBM.

Second, there’s formulary complexity. Insurance plans change their lists of covered drugs every year. A drug that was covered last year might be dropped this year. Your doctor might prescribe a generic you’ve never heard of, and you won’t know if it’s covered until you get to the pharmacy. In 2024, 22% of Medicare beneficiaries said they had trouble getting prior authorization for brand-name drugs-even when their doctor said the generic didn’t work.

Third, there’s prescriber resistance. Doctors aren’t always happy with the system. Many feel pressured to write prescriptions for generics even when they’re unsure they’ll work for a specific patient. In one case, a patient with epilepsy was switched to a generic antiseizure drug. The generic worked fine for most people-but for her, it triggered seizures. Her insurance denied the brand-name drug for months until her doctor fought back with multiple appeals.

What’s Changing in 2025 and Beyond

The system is under pressure. In 2025, new rules require insurers to show the actual cost of drugs on EOBs-not just the copay. This will make spread pricing harder to hide.

The Inflation Reduction Act is also starting to take effect. Starting in 2026, Medicare will begin negotiating prices for some brand-name drugs. This won’t directly affect generics-but it will shift the balance. If a brand-name drug gets cheaper, insurers might relax their strict generic-only rules.

Meanwhile, CMS is launching the GENEROUS Model in 2026. It’s a Medicaid program designed to cut drug spending by $40 billion over ten years by negotiating lower generic prices and standardizing coverage rules across states.

And PBMs? They’re still the middlemen. CVS Caremark, OptumRx, and Express Scripts control 83% of all prescription transactions. They’re making billions in rebates and spreads. Critics say they’re the reason patients don’t see the full savings. Supporters say they’re the only thing keeping drug prices from exploding.

One thing is clear: Generics aren’t going away. They’re the backbone of modern insurance benefit design. But the question isn’t whether to use them-it’s who gets to keep the savings. Right now, the system is rigged to benefit insurers and middlemen. Patients are left guessing why their $5 drug costs $15.

What You Can Do

Don’t just accept what your insurance says. Here’s how to protect yourself:

- Always ask your pharmacist: "What’s the cash price if I don’t use insurance?" Sometimes, paying out of pocket is cheaper.

- Check your plan’s formulary online before your doctor writes a prescription. Look for the tier and copay.

- If a generic doesn’t work, ask your doctor to write "dispense as written" or file a prior authorization appeal.

- Review your Explanation of Benefits. If your copay seems too high for a generic, call your insurer and ask for a breakdown.

- Consider using a direct-to-consumer pharmacy like Mark Cuban Cost Plus Drug Company if you’re uninsured or pay high copays.

Generics saved the U.S. healthcare system trillions. But they only work if patients actually benefit from the savings. Until the pricing system gets transparent, you have to be your own advocate.

8 Comments

So basically my $10 generic copay is just a scam where the pharmacy got paid $3 and the middleman pocketed $7? Wow. No wonder I feel like I'm being played every time I pick up my blood pressure med. 🤡

Insurance companies are the real drug dealers here. They profit off your confusion. They don’t care if the generic gives you migraines or makes you cry in the shower. They just want the spread. And you’re paying for it. End of story.

Stop acting like generics are some magical solution. I had a seizure med switched to generic and ended up in the ER. Now my insurance won’t cover the brand unless I jump through 17 hoops. This isn’t savings-it’s medical roulette.

It’s not just about cost-it’s about ethics. When a system rewards middlemen for obscuring pricing and forces patients into potentially unsafe substitutions, it’s not healthcare. It’s corporate exploitation dressed up as efficiency. We need transparency laws, not band-aids.

And don’t tell me to "just pay cash"-that’s not a solution, it’s a cop-out for people who can’t afford to be their own pharmacist.

The fact that 62% of seniors don’t understand how their copay works isn’t their fault. It’s the system’s failure. If you’re going to mandate generics, at least make the pricing transparent.

And yes, I know the math: generics saved $3.7 trillion. But that money didn’t go to patients. It went to PBMs and shareholders. That’s not a win. That’s theft with a white coat.

When your Explanation of Benefits says "you paid $15" but the drug cost $5, that’s not a copay. That’s a tax on ignorance.

And the "dispense as written" loophole? It’s a joke. Doctors are overworked. They don’t have time to fight every battle. So patients suffer. That’s not healthcare. That’s negligence by design.

Maybe if insurers weren’t making billions off spread pricing, we wouldn’t need Mark Cuban’s pharmacy to expose how broken this system is.

Until we break up the PBMs and force full price transparency, we’re not fixing healthcare-we’re just rearranging the deck chairs on the Titanic.

Bro I just checked my last EOB and my $12 generic was actually $4.50 cost?? 😳 I called my insurer and they said "oh that’s just the spread"... so I’m paying $7.50 extra for nothing?? I’m switching to Mark Cuban’s place next time 😤

One must contemplate the metaphysical implications of pharmaceutical commodification wherein the human body becomes a mere ledger entry in the grand algorithm of corporate profit maximization. The generic drug, though chemically identical, is ontologically alienated from its therapeutic purpose when subjected to the bureaucratic machinery of insurance intermediaries. The patient, caught in this labyrinth of formularies and spreads, is not merely a consumer but a cipher in a system that has forgotten the Hippocratic oath. The true disease is not hypertension or depression-it is the erosion of trust in the healer’s role. We must ask: who holds the moral authority to decide which molecule is worthy of coverage? The answer lies not in economics, but in ethics.

Respected members of this community, I humbly submit that the systemic issues outlined in this post require structural reform, not individual workarounds. The PBM model must be regulated as a public utility. Generic substitution should be optional, not mandatory. Transparency in pricing is not a privilege-it is a right. Let us advocate for policy change at the federal level. The time for passive acceptance has passed.

My mom’s Medicare plan just switched her generic to a different one and now she’s dizzy all day. They won’t cover the original even though her doctor says it’s the only one that works. So now she’s paying $40 out of pocket for the same drug she used to get for $5. Thanks, insurance.