Regulatory Capture: How Industry Influence Undermines Public Protection

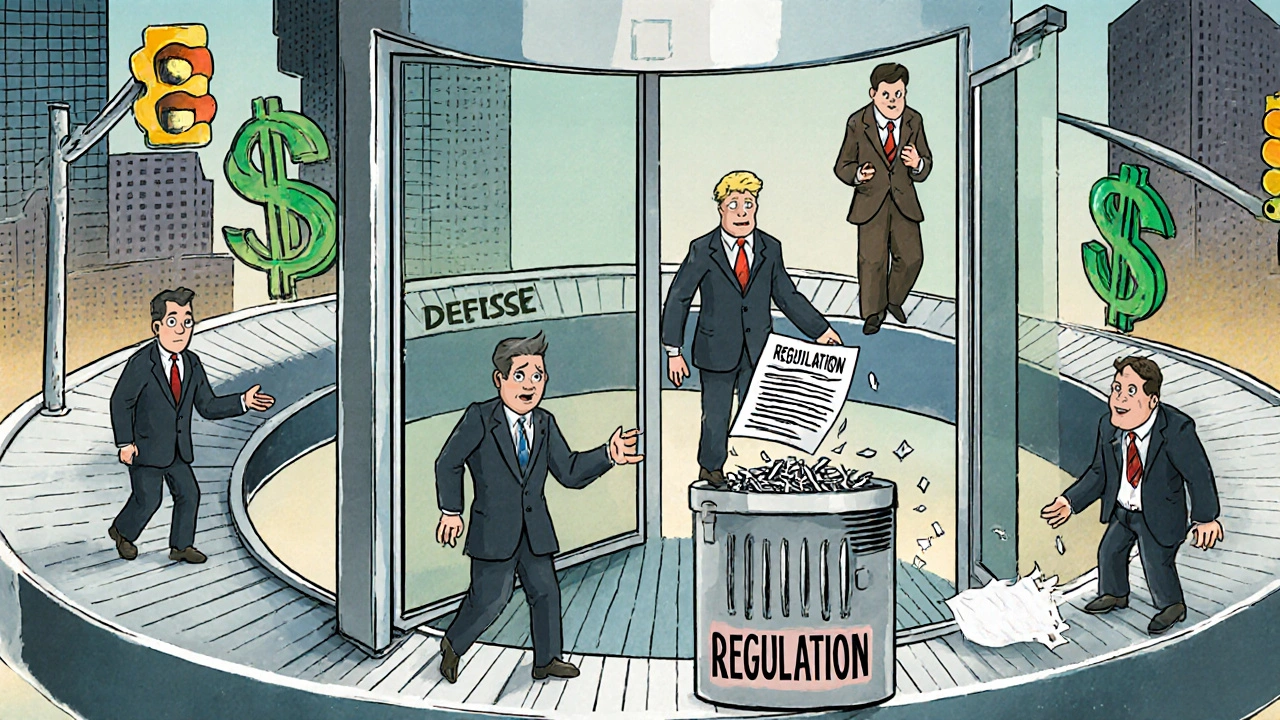

Imagine a safety inspector who used to work for the company they’re supposed to be watching. They know the CEO personally. They go to the same conferences. They even tweet about how hard it is to "crack down on innovation." Now picture that inspector approving a product that’s known to be risky-because they don’t want to upset their old colleagues. This isn’t fiction. It’s regulatory capture.

What Regulatory Capture Really Means

Regulatory capture happens when the agencies meant to protect the public end up serving the industries they’re supposed to regulate. It’s not always bribery or corruption. Often, it’s quieter-like a regulator slowly thinking like the companies they oversee. The idea isn’t new. Economist George Stigler first described it in 1971, pointing out that industries don’t just fight regulation-they learn to shape it.

Take the U.S. sugar industry. For decades, tariffs kept sugar prices three times higher than the global market. Why? Because a few thousand sugar producers made billions in extra profits. Meanwhile, every American household paid about $33 a year extra-money spread so thin across millions of people that no one noticed. The regulators didn’t act because the winners were loud and organized. The losers? Silent.

How It Happens: The Three Main Ways

Regulatory capture doesn’t happen overnight. It builds through three common paths.

- Materialist capture: This is the obvious kind-money changing hands. Lobbying, campaign donations, and the revolving door. The U.S. Department of Defense saw 53% of its top officials join defense contractors within a year of leaving government. The SEC had 87% of its staff with ties to Wall Street firms they were supposed to police before the 2008 crash.

- Cultural capture: This is subtler. Regulators spend years working with industry experts. They start to believe the same things. They see the companies as partners, not threats. A 2021 study found agencies with formal industry advisory committees were 3.7 times more likely to approve rules that favored those companies.

- Information asymmetry: Regulators don’t know everything. Industries do. When a regulator needs to understand how a new drug works or how a cryptocurrency algorithm functions, they turn to the company for data. Over time, they become dependent. That’s not just convenience-it’s control.

Real Cases You’ve Probably Heard Of

Boeing’s 737 MAX crashes didn’t happen because engineers made a mistake. They happened because the FAA let Boeing employees do 96% of the safety checks themselves. The regulator outsourced its own job.

In the UK, HM Revenue and Customs gave 1,842 multinational companies secret tax deals worth an average of £427 million each-while telling the public they were collecting a 19% corporate tax rate. The public never saw the numbers. The companies did.

In energy, the UK’s OFGEM approved £17.8 billion in consumer bill hikes over five years to fund grid upgrades. But energy companies kept profit margins at 11.2%, way above the 6.8% limit. Regulators didn’t push back. Why? Because they trusted the companies’ claims about costs.

Why the Public Doesn’t Fight Back

Here’s the cruel part: the people hurt by regulatory capture rarely organize. The sugar tariffs cost each household $33 a year. That’s annoying, but not life-changing. Meanwhile, sugar producers made $1.2 billion extra. They hired lobbyists. They funded political campaigns. They wrote regulations.

Studies show industry groups spend 17 times more per person on lobbying than consumer groups. Why? Because their stakes are huge. For a drug company, a single regulation change can mean billions. For you? A slightly higher pharmacy bill.

And when people do speak up? The system ignores them. A 2023 Pew survey found 78% of Americans are deeply concerned about industry influence over regulators. But that concern doesn’t translate into pressure. It just breeds cynicism.

What’s Being Done-And Why It’s Not Working

There are rules meant to stop this. The U.S. Ethics in Government Act requires a “cooling-off period” before former officials can join regulated industries. But Public Citizen found 41% of violations go unpunished.

The EU has a Transparency Register for lobbyists. Only 32% of big corporations even bother to comply.

Canada tried training regulators to be more independent. It worked-meeting times with industry dropped 27%, and public stakeholder input rose 43%. But those programs are rare. Most agencies don’t have the budget, the will, or the political cover to change.

And then there’s the rise of algorithmic lobbying. In 2023, MIT found AI tools could generate 17,000 personalized regulatory comments per hour. Companies flood agencies with fake public support. Regulators can’t tell what’s real. The system is being hacked.

Where Things Are Improving

Not all hope is lost. New Zealand’s Regulatory Standards Bill cut industry-preferred regulations from 68% to 31% in six years. How? They forced regulators to prove every rule served the public-not just the powerful.

France’s Citizen’s Convention on Climate brought 150 randomly selected citizens into climate policy talks. Their recommendations cut energy industry influence by over half. Why? Because they weren’t lobbyists. They weren’t industry insiders. They were ordinary people with no stake in the game.

The U.S. Federal Trade Commission launched its own Regulatory Capture Initiative in March 2023. It’s small-$23 million budget-but it’s the first federal effort to directly name and track capture. They’re requiring full disclosure of all industry contacts. That’s a start.

What You Can Do

You might think this is too big for one person. But here’s the truth: regulatory capture survives because people believe they can’t change it.

- Ask your representatives: Do they support independent oversight of agencies? Do they back transparency laws?

- Support watchdog groups like Public Citizen or the Center for Responsive Politics. They track the revolving door. They expose hidden deals.

- When you hear about a drug price spike, a utility bill hike, or a product recall, ask: Who was supposed to stop this? And why didn’t they?

Regulation isn’t broken because it’s flawed. It’s broken because power learned how to bend it. The fix isn’t more rules. It’s more eyes. More voices. More people who refuse to let industry write the rules that govern their lives.

Is regulatory capture the same as corruption?

Not exactly. Corruption involves illegal acts like bribery or kickbacks. Regulatory capture is often legal-just deeply unfair. It’s when industry influence becomes so normalized that regulators no longer see themselves as public servants, but as partners to the companies they oversee. The money might not change hands, but the outcome does.

Which industries are most affected by regulatory capture?

Finance, energy, pharmaceuticals, and defense top the list. The World Bank found 67% of financial regulators show signs of capture, followed by 58% in energy and 52% in pharmaceuticals. These industries have high profits, complex rules, and deep pockets-making them ideal for shaping regulation. Even emerging sectors like cryptocurrency are catching up, spending $128 million on U.S. lobbying in 2022 alone.

How does the revolving door contribute to regulatory capture?

The revolving door is one of the biggest drivers. When regulators know they’ll get a high-paying job in the industry after leaving government, they’re less likely to be tough. A 2022 study found 92% of former SEC commissioners took jobs with regulated firms within 18 months. That’s not coincidence-it’s incentive. Agencies with strong revolving door patterns see 62% fewer enforcement actions and 47% longer response times to violations.

Can regulators ever be truly independent?

Yes-but only with strong guardrails. Canada’s training programs, New Zealand’s independent review process, and France’s citizen assemblies show it’s possible. The key is separating decision-making from industry influence. That means limiting private meetings, requiring public disclosure of all contacts, and ensuring regulators have access to independent technical experts-not just those paid by the industry.

Why don’t voters punish politicians who allow regulatory capture?

Because the effects are invisible. You don’t see the regulator cozying up to a CEO. You don’t see the lobbying emails. You just see higher prices, delayed recalls, or safety failures. And by the time you notice, the damage is done. Plus, industries spend millions to make sure voters blame someone else-like “big government” or “inefficient bureaucracy.” The real culprit? A system designed to be captured.

What Comes Next

The next decade will decide whether regulatory capture becomes a permanent feature of democracy-or a broken system we fix. With AI-powered lobbying, global supply chains, and complex technologies like gene editing and crypto, the stakes are higher than ever. The industries that win will be the ones who control the rules. The question is: whose rules will they be?

The answer lies in who speaks up. Not the lobbyists. Not the CEOs. But the people who pay the bills, take the risks, and get hurt when regulation fails. If enough of them demand transparency, accountability, and independence-then even the most captured agency can be reclaimed.

13 Comments

This is so real... I mean, like, seriously... I work in a regulatory agency, and I’ve seen it firsthand. The revolving door? It’s not a door-it’s a turnstile. And everyone’s just... spinning. I used to think I could make a difference. Now I just hope I don’t become one of them. 😔

Hey, thanks for laying this out so clearly. I’ve been feeling this in my job too-like I’m stuck between doing what’s right and keeping my job. You’re not alone. Keep speaking up. 💪

THEY’RE ALL IN ON IT. THE SYSTEM IS ROTTEN FROM THE INSIDE. THEY DON’T EVEN TRY TO HIDE IT ANYMORE. IT’S NOT A FLAW-IT’S THE FEATURE.

Oh wow, a post that doesn’t blame the poor or the ‘woke’? Radical. Next you’ll tell me the sky is blue and water is wet. Did you get this from a TED Talk or did you actually read a book? 😏

Wait, so you’re saying the problem isn’t government overreach, but government underreach? That’s… actually a new one. I thought the left was supposed to hate regulation. Are we all just confused now? 🤔

This is so important. I’m not a policy wonk, but I know when I’m being ripped off. I bought a recalled toy last year. My kid was fine, but I lost trust. If regulators were truly independent, this wouldn’t happen. Please, someone fix this. I’m tired of being the sucker.

Hi everyone-just wanted to add something from my work in public health. When we tried to push for better labeling on processed foods, the industry flooded us with ‘data’ from consultants they paid. We spent 18 months chasing ghosts. The real data? Buried. Don’t trust ‘studies’ from companies that profit from the product. Always ask: who funded this? 🌱

Regulatory capture is just neoliberalism’s polite face. The state is a service provider for capital, not a protector of citizens. The OECD has been documenting this since the 90s. What’s new is that the public is finally noticing. But the media? Still parroting industry talking points. #StructuralCrisis

LOL, you think this is unique to the US? In India, pharma regulators get ‘consultancy fees’ from companies they approve. We call it ‘jugaad’-but it’s just capture with a smile. The system doesn’t care if you’re rich or poor-only if you’re loud enough.

One of the most important pieces I’ve read this year. The data is overwhelming, the examples are chilling, and the solutions-while difficult-are not impossible. We need to stop treating this as a political issue and start treating it as a civic emergency. Thank you for writing this.

They don’t even bother hiding it anymore. The 737 MAX wasn’t a failure-it was a feature. The regulators didn’t fail. They were hired to fail. And now they’re writing the obituary for democracy while sipping $12 lattes at the same conference where they met their next CEO job. This isn’t corruption. It’s capitalism with a corporate ID badge.

Can we talk about the fact that AI-generated comments are now outnumbering real public input by 500 to 1? The FTC’s new initiative is a start, but it’s like trying to stop a tsunami with a broom. We need to ban automated lobbying comments. Period. And require all regulatory submissions to be human-verified. Otherwise, democracy is just a simulation.

Man, I read this and just thought-how do we even fix this? I’m not a lawyer or a politician. But I’m gonna start asking my reps about this every time they email me. Maybe if enough of us do, it’ll matter.